Hello, and welcome to my article on managed investment funds performance. In this section, I will provide an overview of the factors that influence the performance of these funds and how they can impact your investment returns.

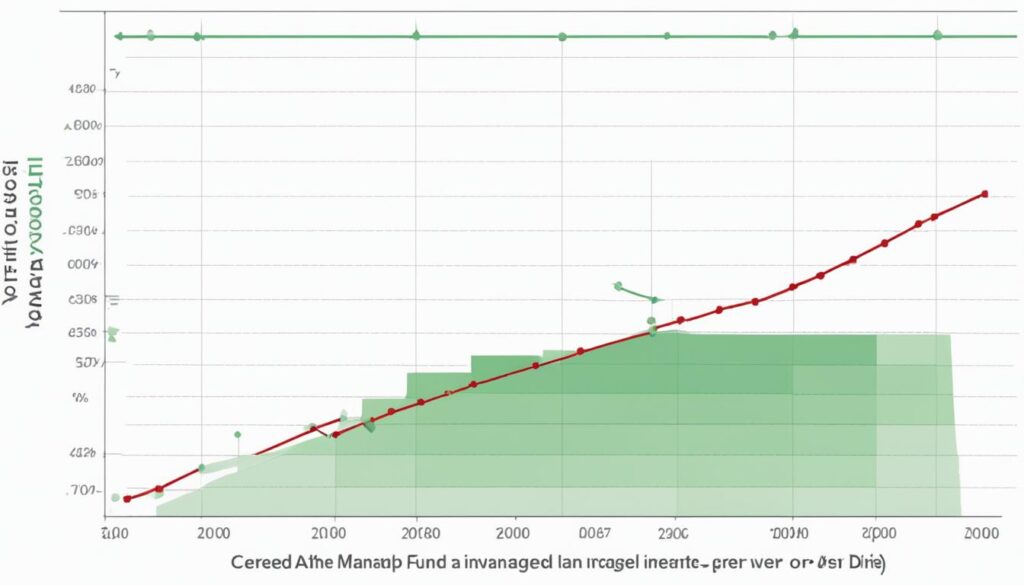

When investing in managed investment funds, it is essential to understand the performance data shown in tables and graphs on this page. This data is calculated in USD of the fund/index/average (as applicable), on a Bid To Bid / Nav to Nav basis, with gross dividends re-invested on ex-dividend date. It is important to note that past performance is not necessarily a guide to future performance, and unit prices may fall as well as rise.

Table of Contents

ToggleKey Takeaways:

- The performance of managed investment funds is influenced by various factors.

- Past performance is not a guarantee of future results.

- Unit prices of funds may fall as well as rise.

- It is essential to analyze performance data and understand the calculations.

- Consider these factors carefully when making investment decisions.

Importance of Diversification in Managed Investment Funds Performance

Diversification is a critical factor in achieving optimal performance for managed investment funds. By spreading investments across various asset classes, sectors, and regions, fund managers aim to reduce the impact of any individual investment on the overall fund performance.

When a portfolio is well-diversified, it can help to mitigate losses during times of market volatility, as different investments may react differently to changing market conditions. This strategy aims to balance risk and return, enhancing the fund’s stability and potential for long-term growth.

Moreover, diversification enables exposure to a broader range of potential opportunities. By investing in different industries and regions, fund managers can capitalize on growth sectors while minimizing the impact of any underperforming investments.

Ultimately, diversification offers investors the potential for steady returns and helps to protect their capital against significant market fluctuations. It is a key element in managing risk and achieving consistent performance in managed investment funds.

Diversification Example:

| Asset Class | Allocation Percentage |

|---|---|

| Equities | 60% |

| Bonds | 25% |

| Real Estate | 10% |

| Commodities | 5% |

By diversifying across these asset classes, fund managers can potentially benefit from the growth of equities, the stability of bonds, the income generation of real estate, and the diversifying effect of commodities. This diversified portfolio spreads the risk, offering a better chance of favorable returns while controlling overall risk exposure.

The Role of Risk Management in Managed Investment Funds Performance

Risk management plays a crucial role in achieving optimal performance in managed investment funds. As a fund manager, I understand the importance of assessing and controlling risks associated with different investments. By employing various risk management strategies, I aim to protect investors’ capital and maximize returns.

One of the key aspects of risk management is analyzing market trends and conducting thorough research. By staying informed about market conditions, I can identify potential risks and make informed investment decisions. This helps me allocate resources effectively and avoid unnecessary exposure to volatile market movements.

In addition, implementing risk mitigation techniques such as hedging and portfolio rebalancing is crucial. Hedging allows me to protect the fund from adverse market conditions by taking offsetting positions. This helps minimize potential losses and maintain stability in the fund’s performance.

Furthermore, portfolio rebalancing is essential in managing risk. By periodically adjusting the asset allocation of the fund, I can align it with changing market dynamics and investors’ risk tolerance. This ensures a well-diversified portfolio, reducing the impact of any single investment on the overall fund performance.

By effectively managing risks, I aim to provide a stable and consistent performance for the managed investment funds. This allows investors to have confidence in their investment and achieve their financial goals.

“Risk comes from not knowing what you’re doing.” – Warren Buffett

The Importance of Risk Management

Risk management is not only crucial for protecting investors’ capital but also for enhancing returns. By proactively identifying and managing risks, fund managers can seize potential opportunities and optimize the fund’s performance.

Diversification and Risk Management

A key strategy in risk management is diversification. By spreading investments across different asset classes, sectors, and regions, fund managers can minimize the impact of any single investment on the overall portfolio. This helps mitigate the risk of losses and provides a more stable return profile.

Monitoring and Adjusting Risks

Effective risk management involves continuous monitoring and adjustment. As market conditions change, it is important to reassess risks and adjust investment strategies accordingly. This proactive approach enables fund managers to navigate through uncertainties and maintain a robust performance.

The Importance of Investment Strategy in Managed Investment Funds Performance

An effective investment strategy is vital for achieving consistent performance in managed investment funds. Fund managers employ various strategies such as value investing, growth investing, and income investing to identify investment opportunities that align with the fund’s objectives. The choice of investment strategy depends on factors such as the fund’s risk tolerance, time horizon, and market conditions. A well-defined investment strategy helps fund managers to make informed decisions and optimize fund performance.

“The investor’s chief problem—and even his worst enemy—is likely to be himself. In the end, how your investments behave is much less important than how you behave.” – Benjamin Graham

Investment strategy plays a fundamental role in shaping the performance of managed investment funds. It determines the approach fund managers will take when selecting and managing investments within the fund. Different strategies cater to different investment objectives and risk profiles. For instance, a value investing strategy focuses on identifying undervalued securities with the potential for long-term growth, while a growth investing strategy prioritizes investments in companies with above-average earnings growth rates. On the other hand, an income investing strategy seeks out investments that generate regular income, such as dividend-paying stocks or fixed-income securities.

By adopting a specific investment strategy, fund managers are better equipped to navigate the complexities of the financial markets and identify opportunities that align with the fund’s goals. A clear investment strategy provides a framework for decision-making, guiding fund managers in their asset allocation, stock selection, and risk management practices.

It’s important to note that investment strategies are not static and can evolve over time. Fund managers continuously evaluate and adapt their strategies based on market conditions, emerging trends, and the fund’s performance objectives. This dynamic approach allows for flexibility in responding to changing market dynamics and investor preferences.

Benefits of a Well-Defined Investment Strategy

A well-defined investment strategy offers several benefits for managed investment funds:

- Consistency in decision-making: A clear investment strategy enables fund managers to make consistent investment decisions aligned with the fund’s objectives, minimizing the impact of emotional biases and short-term market fluctuations.

- Optimized risk-return tradeoff: By carefully selecting investments based on the fund’s risk tolerance and expected returns, a well-defined investment strategy helps to strike an optimal balance between risk and potential returns.

- Enhanced performance evaluation: A defined investment strategy provides a benchmark against which fund performance can be measured, enabling investors to assess the fund’s relative performance and the effectiveness of the chosen strategy.

- Improved transparency and accountability: Clearly communicating the investment strategy to investors fosters transparency and accountability, ensuring alignment of expectations and reducing the likelihood of misunderstandings.

Overall, a robust investment strategy is a key driver of long-term success for managed investment funds. It guides fund managers in navigating market complexities, making informed investment decisions, and optimizing performance for the benefit of investors.

Benchmarking in Managed Investment Funds Performance Evaluation

Benchmarking plays a crucial role in evaluating the performance of managed investment funds. As an investor, it is essential to understand how well a fund has performed relative to its benchmark. By comparing a fund’s returns against a relevant market index or a peer group of funds with similar investment objectives, you can gain valuable insights into its performance.

When benchmarking a managed investment fund, fund managers analyze the fund’s returns over a specific period and compare them to the returns generated by the benchmark. This comparison allows investors to assess the fund’s relative performance and determine if it has outperformed or underperformed the benchmark.

Benchmarking provides transparency and accountability in assessing the performance of managed investment funds. It allows investors to evaluate a fund manager’s skill in generating returns and provides a basis for future investment decisions.

One popular benchmark for evaluating managed investment funds is the S&P 500 index, which tracks the performance of 500 large-cap U.S. stocks. Comparing a fund’s returns to the S&P 500 can help investors understand how well the fund has performed in relation to the broader U.S. stock market.

Below is an example of benchmarking a managed investment fund’s performance against the S&P 500 index:

| Fund | Annual Return | S&P 500 Index |

|---|---|---|

| Fund A | 10% | 8% |

| Fund B | 12% | 10% |

| Fund C | 8% | 9% |

In the example above, Fund A has outperformed the S&P 500 index with an annual return of 10% compared to the index’s return of 8%. Fund B has also outperformed the index with a return of 12% compared to 10%. On the other hand, Fund C has underperformed the index with a return of 8% compared to 9%.

By benchmarking a fund’s performance, investors can assess its relative performance, understand the fund manager’s skill in generating returns, and make informed investment decisions.

The Role of Asset Allocation in Managed Investment Funds Performance

Asset allocation is a critical factor in determining the performance of managed investment funds. Fund managers allocate assets across different asset classes, such as stocks, bonds, and cash, based on their assessment of market conditions and investment objectives. By strategically diversifying their portfolios, fund managers aim to optimize returns while effectively managing risk.

Asset allocation involves dividing investments among different categories to spread risk and potentially increase the likelihood of positive returns. This approach allows fund managers to capitalize on the performance of various asset classes, such as equities, fixed income, and alternative investments, each with its own risk and return characteristics.

“Asset allocation is the most important decision an investor can make.” – J.P. Morgan

Effective asset allocation requires careful analysis and understanding of the market environment, economic conditions, and investor goals. By assessing these factors, fund managers determine the appropriate allocation across asset classes to achieve the desired risk-return profile.

Fund managers continuously monitor and evaluate the performance of different asset classes and make adjustments to the allocation based on market trends and investment outlook. This dynamic approach ensures that the fund remains aligned with its objectives and can adapt to changing market conditions.

The Benefits of Asset Allocation in Managed Investment Funds

1. Risk management: Asset allocation helps to mitigate overall portfolio risk by diversifying investments across different asset classes that may have different risk profiles. When one asset class underperforms, other classes may compensate, reducing the impact on the overall portfolio.

2. Return optimization: By allocating investments across various asset classes, fund managers aim to capture the potential returns offered by each class. This diversification can increase the likelihood of generating consistent returns over the long term.

3. Capital preservation: Balancing investments across asset classes can offer protection against significant losses in any one sector, as losses in one asset class may be offset by gains in others.

4. Adaptability: Asset allocation allows fund managers to adjust the portfolio in response to changing market conditions, providing flexibility to capitalize on emerging investment opportunities or manage potential risks.

Key Considerations for Asset Allocation

When determining asset allocation strategies, fund managers consider various factors, including:

- Investor risk tolerance

- Investment goals and time horizon

- Market conditions and economic outlook

- Asset class correlation

- Historical performance of different asset classes

It is important to note that asset allocation does not guarantee investment success or protect against losses. The performance of managed investment funds is subject to market fluctuations and other factors beyond the fund manager’s control.

| Asset Class | Allocation |

|---|---|

| Stocks | 60% |

| Bonds | 30% |

| Cash | 10% |

This hypothetical asset allocation table illustrates the allocation percentages across different asset classes. Actual allocation percentages may vary based on specific investment strategies and market conditions.

Transparency in Managed Investment Funds Performance Analysis

When it comes to analyzing the performance of managed investment funds, transparency plays a crucial role. As an investor, having access to accurate and comprehensive information is essential for making informed decisions. Fund managers understand this, which is why they prioritize transparency by providing regular reports and disclosures.

These reports and disclosures offer detailed insights into the fund’s holdings, performance, fees, and expenses. By examining this information, investors can gain a clear understanding of how the fund has performed over time and assess its suitability for their investment goals.

Transparency not only empowers investors but also fosters trust and accountability between fund managers and investors. By openly sharing information, fund managers demonstrate their commitment to providing reliable data and facilitating a long-term relationship based on trust.

Within these reports, investors can discover valuable details about the fund’s investment strategies, risk management practices, and portfolio allocations. This enables investors to evaluate the fund’s performance accurately, identifying areas of strength and potential risks.

Additionally, transparency in reporting fees and expenses allows investors to account for these factors when assessing the fund’s overall performance. It ensures investors have a comprehensive view of the costs associated with the investment, aiding in making informed comparisons with other funds.

Overall, transparency in managed investment funds’ performance analysis is essential for providing investors with the information they need to make sound investment decisions. By prioritizing transparency, fund managers uphold their duty to provide accurate data, promote accountability, and build trust with investors.

Factors to Consider in Analyzing Fund Performance

When analyzing the performance of managed investment funds, there are several key factors that investors should take into consideration. These factors provide valuable insights into the fund’s performance potential and help investors make informed investment decisions.

1. Historical Performance

The fund’s historical performance is an important metric to evaluate. It allows investors to assess how the fund has performed over time and provides an indication of its ability to generate consistent returns. By analyzing historical performance, investors can gain insights into the fund’s track record and assess its potential for future growth.

2. Consistency of Returns

Consistency of returns is another crucial factor to consider. Investors should evaluate whether the fund has consistently generated positive returns or if it has experienced significant fluctuations. Consistency in returns indicates the fund’s ability to weather market volatility and deliver stable growth.

3. Risk Management Practices

Risk management practices play a vital role in determining the fund’s performance. Investors should examine how the fund’s manager assesses and mitigates risks associated with investments. Effective risk management strategies help to protect the fund’s capital and minimize potential losses.

4. Fees and Expenses

Fees and expenses are an essential consideration when analyzing fund performance. Investors should assess the fund’s expense ratio, management fees, and any other related costs. High fees can eat into the fund’s returns, potentially affecting overall performance.

5. Fund Manager’s Expertise

The expertise and track record of the fund manager are critical factors to evaluate. Investors should research the fund manager’s experience, qualifications, and investment philosophy. A skilled and experienced fund manager can significantly impact a fund’s performance.

6. Alignment with Financial Goals and Risk Tolerance

Investors should assess whether the fund aligns with their financial goals and risk tolerance. Different funds cater to various investment objectives, such as growth, income, or a balanced approach. It is essential to choose a fund that aligns with individual investment preferences.

| Factors to Consider | Description |

|---|---|

| Historical Performance | Evaluate the fund’s past performance to gain insights into its track record and potential for future growth |

| Consistency of Returns | Assess whether the fund has consistently generated positive returns and stability |

| Risk Management Practices | Examine how the fund manager assesses and mitigates risks associated with investments |

| Fees and Expenses | Evaluate the fund’s expense ratio, management fees, and related costs |

| Fund Manager’s Expertise | Research the fund manager’s experience, qualifications, and investment philosophy |

| Alignment with Financial Goals and Risk Tolerance | Assess whether the fund aligns with individual investment preferences and risk tolerance |

By thoroughly analyzing these factors, investors can make informed decisions when selecting managed investment funds. It is essential to consider each factor holistically and in conjunction with one another, as they collectively contribute to the overall performance and suitability of the fund.

Conclusion

In conclusion, managed investment funds’ performance is highly influenced by several critical factors. Diversification, risk management, investment strategy, benchmarking, asset allocation, and transparency all play significant roles in determining the success of these funds.

Investors seeking optimal returns should carefully assess these factors when evaluating fund performance and selecting suitable funds that align with their investment objectives. By conducting thorough research and considering all relevant factors, investors can make informed decisions that have the potential to maximize their investment returns.

It is important to remember that past performance, as shown in tables and graphs, is not necessarily a guide to future performance. Investors should recognize that unit prices may rise and fall, and traditional performance trends may change. Therefore, continuous evaluation and monitoring of managed investment funds are crucial to ensure ongoing success.

FAQ

What role does diversification play in the performance of managed investment funds?

Diversification helps to spread the risk across different asset classes, sectors, and regions, reducing the impact of any single investment on the overall performance of the fund. This strategy can help to mitigate losses and smooth out returns during market volatility.

How does risk management contribute to optimal performance in managed investment funds?

Risk management involves assessing and controlling the risks associated with different investments. Fund managers analyze market trends, conduct research, and employ strategies such as hedging and portfolio rebalancing to mitigate risks. Effective risk management aims to protect investors’ capital and maximize returns.

What is the importance of investment strategy in managed investment funds performance?

Investment strategy is crucial for achieving consistent performance. Fund managers employ strategies such as value investing, growth investing, and income investing to identify opportunities aligned with the fund’s objectives. The choice of strategy depends on factors such as risk tolerance and market conditions.

How does benchmarking evaluate the performance of managed investment funds?

Benchmarking compares a fund’s returns against a market index or a group of funds with similar objectives. It allows investors to assess how well the fund has performed relative to its benchmark. Benchmarking provides transparency and accountability in evaluating fund performance.

What role does asset allocation play in the performance of managed investment funds?

Asset allocation involves allocating assets across different classes based on market conditions and investment objectives. The right asset allocation can optimize returns while managing risk. Fund managers monitor and adjust asset allocation to maintain the desired risk-return profile and adapt to market changes.

Why is transparency important in analyzing the performance of managed investment funds?

Transparency allows investors to make informed decisions by providing reports and disclosures on fund holdings, performance, fees, and expenses. It promotes trust and accountability between fund managers and investors, fostering a long-term relationship based on reliable information and clear communication.

What factors should investors consider when analyzing fund performance?

Investors should consider factors such as historical performance, consistency of returns, risk management practices, fees and expenses, fund manager expertise, and alignment with their financial goals and risk tolerance. A comprehensive analysis can provide valuable insights into the fund’s performance potential.